Many workers are continuing to stay on the job into their 60s or 70s. How do you keep an aging workforce safely on the job? Read our latest blog for tips by click the graphic. #workersafety

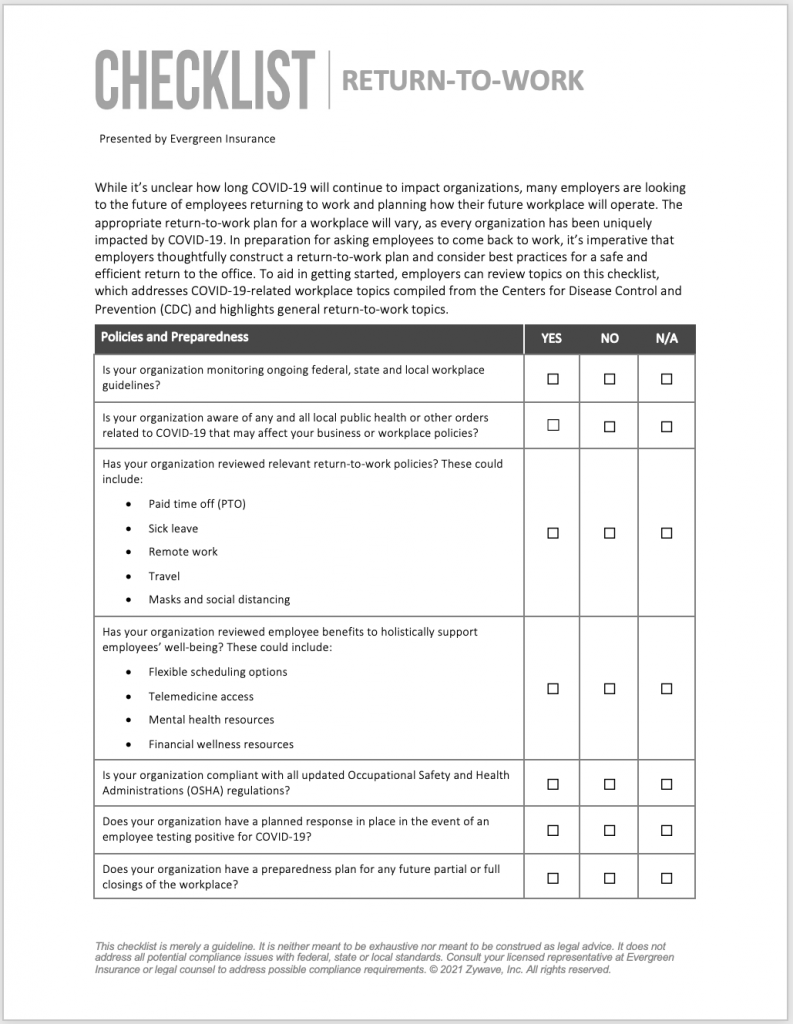

If your company working from home and ready to return to the office or considering a long-term hybrid model, download our checklist so you can cover the issues and risks. Return to office the most efficient and effective way possible. Contact us with questions related to risks associated with return to office.

Agricultural employers, farming contractors, and agricultural associations who transport migrant or seasonal agricultural workers must ensure that their transporting vehicles conform to rigid safety standards. These entities are ultimately responsible for ensuring that drivers have a valid driver’s permit or license to operate the vehicle. In addition, any vehicle used must have a current state vehicle inspection sticker.

Beyond that, the Department of Labor (DOL) established regulations for passenger automobiles and station wagons used to transport 75 miles or less. Use our checklist to ensure that you are abiding by DOL guidelines for transporting your workers.

Click the image to view and download the checklist. For information about farm and agribusiness insurance, contact us.

This checklist is merely a guideline. It is neither meant to be exhaustive nor meant to be construed as legal advice. It does not address all potential compliance issues with federal, state or local standards. Consult your licensed commercial property and casualty representative at Evergreen Insurance LLC or legal counsel to address possible compliance requirements. © 2008, 2019 Zywave, Inc. All rights reserved.

Unexpected events like theft, vandalism or fires can wreak havoc on your personal belongings and cost you a fortune. Renters insurance is an affordable way to protect your belongings from losses—losses that can be far more costly than you may expect.

Let’s examine what renters insurance covers and how to calculate your policy needs.

What Renters Insurance Covers

While policies can vary, most offer coverage for the following:

How Much Renters Insurance Do I Need?

In order to determine the amount of coverage you need for your renters policy, there are a few things you can do:

Securing the Coverage That’s Right for You

Deciding on the amount of renters insurance coverage you need can be a bit tricky. But with the help of your insurance agent, it can make the decision a far easier process.

© 2019 Zywave, Inc. All rights reserved. This Know Your Insurance document is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice.

Workers’ compensation insurance benefits are available to employees who are injured or become ill as a result of a work-related incident. If one of your employees is injured on the job and is medically authorized to take time off from work, he or she will be reimbursed for lost wages and all of the medical expenses related to the treatment and rehabilitation.

What are the reporting procedures for injuries and illnesses?

If employees are injured, they should notify you immediately to file a report. This will initiate the process for receiving workers’ compensation benefits.

How are employees reimbursed?

Lost compensation is payable during the time period in which employees are authorized by their treating physicians. Benefits are paid weekly at a state-specific percentage rate of their average weekly wage, up to a maximum dollar amount. There is also a state-specified waiting period before benefits are available.

What is an independent medical exam (IME)?

An IME is an exam by a medical professional other than the physician who first examined an injured or ill employee. As the employer—and insurance carriers—you can request an IME to confirm an original diagnosis and treatment plan.

What happens if employees do not comply with recommended treatments?

Non-compliance with recommended medical treatments, therapy or return-to-work plans may jeopardize workers’ compensation benefits.

The most important thing is to convince your employees that maintaining a safe workplace is vital and will consequently reduce your insurance costs. Here are some other ways to control costs:

Learn more about Workers’ Compensation or contact us at 800.662.2020.

Disclaimer: This brochure is provided for informational purposes only. The information provided herein is not intended to be exhaustive, nor should it be construed as advice regarding coverage. Eligibility for coverage is not guaranteed and all coverages are limited to the terms and conditions contained in the applicable policy. © 2009, 2013, 2016 Zywave, Inc. All rights reserved.

Did you know that business-related crimes – such as theft, forgery, or fraud – can impact your organization? Watch this video which explains when crime coverage is needed and its benefits. Then contact us to learn more about your options for your business.

Evergreen Insurance added Matthew T. Fry to its production staff. Matt will serve business customers throughout the region from Evergreen’s Pittsburgh office.

“Matt is solutions oriented and has worked with customers in a variety of industries,” said Joe Reschini, Chief Executive Officer of Evergreen Insurance. “We’re pleased to add him to our team focusing on the Pittsburgh region.”

Matt holds licenses in Property & Casualty and Life & Health insurance in Pennsylvania, Ohio, and West Virginia. He has seven years of experience in commercial insurance with sales and claims responsibilities. He is a graduate of Washington and Jefferson College.

Click here to contact Matt Fry.