Employee burnout is real and with the added stressors of the holidays, it can seem unbearable. This article highlights tips to help prevent burnout and enjoy the 2023 holiday season.

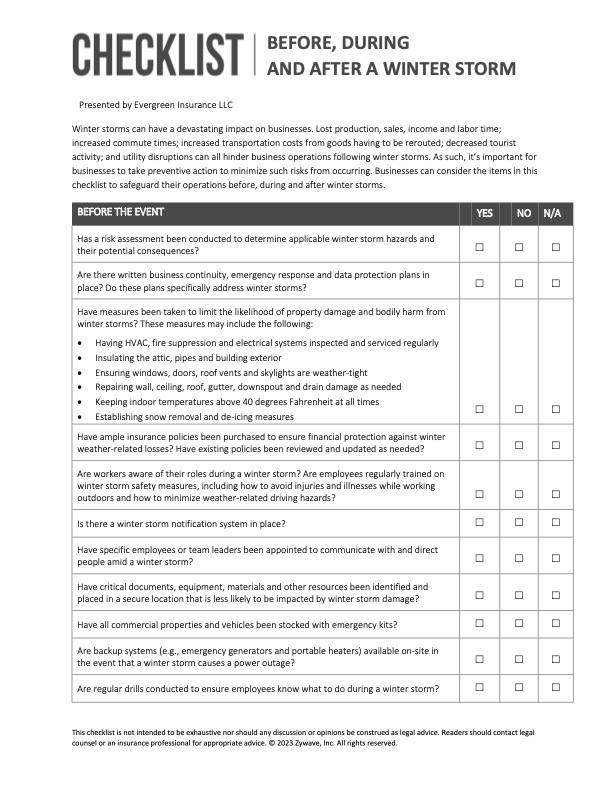

The impact of extreme winter weather events on businesses can be devastating, resulting in major building damage, lost production and sales, and utility disruptions – just to name a few. Are you prepared for winter weather? Click on the images to download or print these free resources for businesses to assess winter risks and know what steps to take before, during, and after a winter weather event.

Cyberattacks and the resulting data breaches represent significant risks, both financial and reputational, to businesses, with insurance industry estimates stating that the $3 trillion price tag currently could balloon to $5 trillion in 2024. Those figures include lost income and the payment of data breach-related regulatory fines.

According to the Insurance Information Institute*, cost-effective options exist to avoid falling victim to cyberattacks, such as:

The threat of cyberattack never goes away, so neither should your defenses against it. Contact the professionals at The Reschini Group to learn more and take the appropriate steps to protect your business interests.

Copyright 2023 Evergreen Insurance

Evergreen Insurance provides these updates for information only, and does not provide legal advice. To make decisions regarding insurance matters, please consult directly with a licensed insurance professional or firm.

“Here today, gone tomorrow.” An old familiar phrase, but never a welcome one when it pertains to a business. But should the worst happen, an option to keep your business on its feet is readily available.

Business interruption insurance helps businesses protect against monetary losses due to periods of suspended operations when a covered event, such as a fire, occurs and causes physical property damage. The coverage allows businesses to pay fixed expenses, including costs incurred while operating at an offsite location, while the property is closed for repairs and restoration. Policies also reimburse owners for lost revenue that would have otherwise been earned if the business remained open.

Business interruption coverages are typically bundled within a businessowner’s policy (BOP), a commercial package that includes business property and liability coverages or a standalone Commercial Property policy. Most insurers offer this coverage feature for accounts that they are willing to insure.

According to the Federal Emergency Management Agency (FEMA), about 25% of businesses fail to reopen after a disaster strikes, making business interruption coverage even more critical for the long-term survival of an enterprise. While commercial property insurance pays for actual physical damages or losses, a business interruption policy covers lost net income due to the closure of the business while repairs are underway, as well as offering coverage for rent or lease payments, relocation costs, employee wages, taxes, and loan payments. Exclusions from coverage include losses unrelated to property damage, such as lost revenues due to viral outbreaks or pandemics.

Business interruption policies may contain a clause for civil authority coverage, as well, meaning that if a state, local, or federal government entity prohibits access to the business premises, thereby forcing the business to temporarily close, this clause in the business interruption insurance may cover lost income.

Should a calamity strike, you certainly want to be able to say about your business, “Here today, still here tomorrow.” Business interruption coverage holds the key. Contact the professionals at Evergreen Insurance to learn more and determine the right plan for your business.

https://content.naic.org/cipr-topics/business-interruptionbusinessowners-policies-bop

Copyright 2023 Evergreen Insurance

Evergreen Insurance provides these updates for information only, and does not provide legal advice. To make decisions regarding insurance matters, please consult directly with a licensed insurance professional or firm.

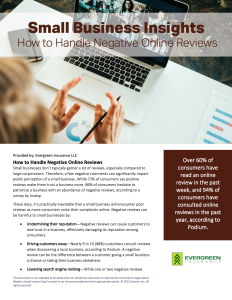

As a small business, a few bad reviews online can greatly affect your business. These reviews can undermine your business’ reputation and cost you money. It’s necessary in today’s world to know how to respond to these complaints and avoid losing business. Click on the image to download or print the tip sheet.

Consumer-driven health plans like health savings accounts (HSAs), flexible spending accounts (FSAs), and health reimbursement arrangements (HRAs), can help soften the blow of continually rising health care costs, but it’s important to understand what each option requires and provides. Here are brief descriptions of the similarities and differences concerning HSAs, FSAs and HRAs:

Due to their tax-favored status, HSAs require individuals to meet these qualifications:

The employer and employee can contribute to the HSA in the same year, subject to annual limits. Employers may allow employees to make pre-tax salary reduction contributions to fund their HSAs. Individuals may roll over unspent funds in the HSA from year to year. Since the HSA is a tax-exempt account owned by the employee, he or she may keep the account upon termination of employment or retirement.

Health FSAs provide a means for employees to reduce their income tax liability through salary reduction. The Affordable Care Act (ACA) limits employee’s pre-tax contributions to their health FSAs to $3,050 (adjusted for inflation for future plan years). Since only employees can participate in a health FSA, self-employed individuals can establish health FSAs for their employees, but cannot set up their own accounts. Also a “use-it-or-lose-it” provision, meaning that employees must use every dollar in the account by the end of each year, which can lead to overfunding the account and then spending unnecessarily at the end of the year to avoid forfeiting the money. Some options for protecting those unused funds exist, but it is best to check with a qualified benefits expert first.

HRAs allow employees to use employer contributions to pay for (or reimburse) eligible medical care expenses. HRAs can only be funded with employer money, and unused HRA balances may accumulate from year to year. There is no specified cap on the amount an employer is allowed to contribute to an HRA. Also, an HRA is not subject to the uniform coverage rule that applies to health FSAs. Like health FSAs, only employees can participate in an HRA, which means that self-employed individuals cannot participate in an HRA on a tax-favored basis.

Introducing consumerism into your health plan requires an evaluation of the benefits and disadvantages of HSAs, FSAs and HRAs. No single solution is right for every employer. If your organization is considering implementing a consumer-driven health plan, the Benefits team at Evergreen Insurance can help determine the best plan for you.

Copyright 2023 Evergreen Insurance

Evergreen Insurance provides these updates for information only, and does not provide legal advice. To make decisions regarding insurance matters, please consult directly with a licensed insurance professional or firm.