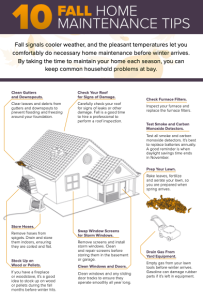

Fall weather is finally here! Take this opportunity to prepare your home for the oncoming winter weather. You don’t want to find yourself in a snowstorm with a leaking roof or bad furnace. Click on the image to download or print the safety sheet.

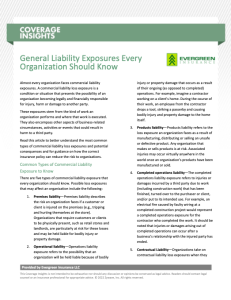

Organizations and businesses everywhere can face general liability exposures from the kind of work they perform and where it is executed. It’s important for your business to understand where these exposures are so you can avoid legal or financial responsibility for damage to another party. Click on the image to download or print the information sheet.

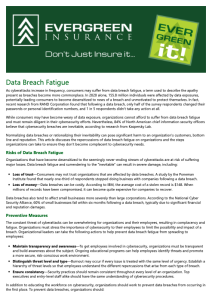

October is National Cybersecurity Awareness Month. In recent years, cyber attacks have increased in frequency. This can result in data breach fatigue as consumers and organizations become desensitized to breaches. Don’t become complacent to cybersecurity needs in your business. Click on the image to download or print the safety sheet.

Evergreen Insurance has been recognized for excellence in the insurance industry. We have been awarded the Best of Westmoreland County 2022 Silver Winner Medallion in the Insurance Company category and the Best of Westmoreland County 2022 Gold Winner Medallion in the Insurance Agent category.

We owe our success to you, our loyal clients. Thank you for supporting and voting for us!

Since our founding in 1980, our goal has been to help people understand the complex risks that they and their business face, and mitigate them by seeking out cost-effective insurance coverages to fit their needs. We strive to serve people professionalism and expertise, as well as educate our clients on the ins and outs of insurance. We are equipped to help you with a full range of coverage options, including commercial, farm, and personal insurance.

Contact us today to discover the confidence that comes with knowing you have the right insurance for yourself, your family, and your business. Don’t just insure it… Evergreen it!

A clear understanding of the rules up-front helps to avoid problems down the road. This can be especially true when it comes to government programs and the tax implications they represent. For example – Health Savings Accounts (HSA), a popular type of tax-advantaged medical savings account available to individuals enrolled in high deductible health plans (HDHPs).

Individuals can use HSAs to pay for expenses covered under the HDHP until their deductible has been met, or they can use their HSAs to pay for qualified medical expenses that are not covered under the HDHP, such as dental or vision expenses.

HSAs provide a triple tax advantage—contributions, interest and earnings, and amounts distributed for qualified medical expenses are all exempt from federal income tax, Social Security/Medicare tax and most state income taxes. But because of an HSA’s potential tax savings, federal tax law includes strict rules for HSAs, including limits on annual contributions and HDHP cost sharing. These limits, which can vary based on whether an individual has self- only or family coverage under an HDHP, include:

Eligible individuals with self-only HDHP coverage will be able to contribute $3,650 to their HSAs for 2022, up from $3,600 for 2021. Eligible individuals with family HDHP coverage will be able to contribute $7,300 to their HSAs for 2022, up from $7,200 for 2021. Individuals who are age 55 or older are permitted to make an additional $1,000 “catch-up” contribution to their HSAs. The minimum deductible amount for HDHPs remains the same for 2022 plan years ($1,400 for self-only coverage and $2,800 for family coverage). However, the HDHP maximum out-of- pocket expense limit increases to $7,050 for self-only coverage and $14,100 for family coverage.

Employers that sponsor HDHPs should review their plan’s cost-sharing limits (minimum deductibles and maximum out-of-pocket expense limit) for 2022. Also, employers that allow employees to make pre-tax HSA contributions should update their plan communications for the increased contribution limits.

Contact the professionals at Evergreen Insurance for more information.

Copyright 2022 Evergreen Insurance

Evergreen Insurance provides these updates for information only, and does not provide legal advice. To make decisions regarding insurance matters, please consult directly with a licensed insurance professional or firm.

Workplaces should be aware of any risks to their employees’ respiratory health. Air particles, dust, and fumes can be dangerous, especially when they are breathed in every day. Make sure your company is dealing with respiratory protection correctly. Click on the image to download or print the safety slides.

If you are found to be legally responsible for an injury, a personal umbrella liability policy can save you from having to pay out of pocket. If you engage in activities with high risks of getting sued, you may want to consider an umbrella policy. Click on the image to download or print the information sheet.