This video provides tips and best practices about grain handling. Learn more and talk to Evergreen about your farm insurance needs, whether a large commercial farm, or a small family home and hobby farm, we have the expertise to help you protect the people and things you love. Don’t just insure it… Evergreen it!

News

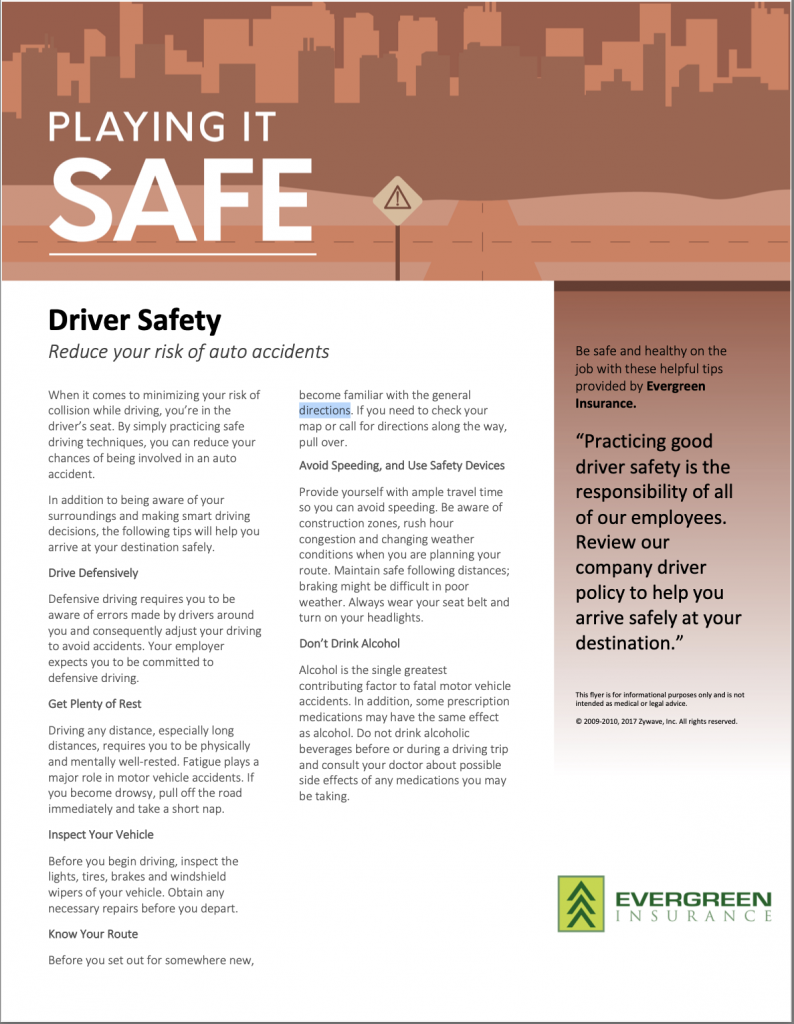

Safer Driving Tips

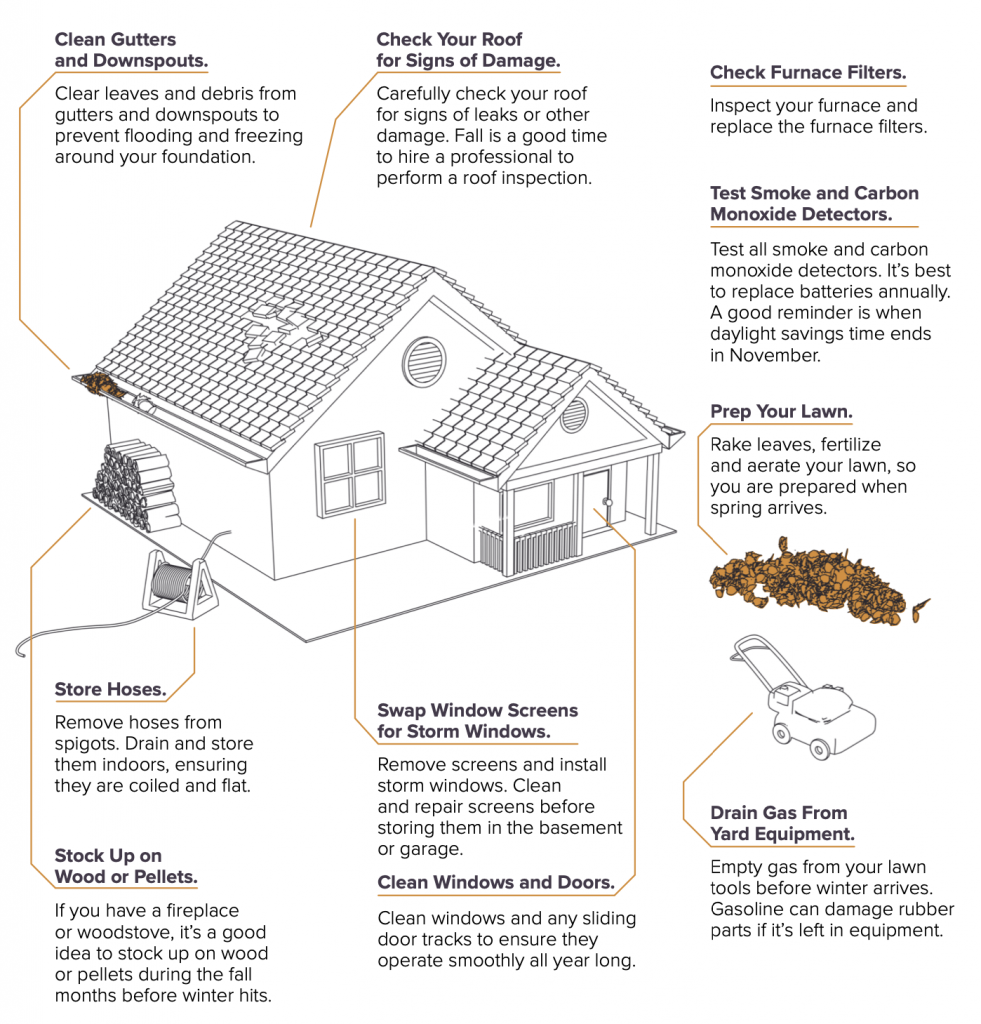

Fall Home Maintenance Tips

Small Business Hiring and Employee Retention Tips

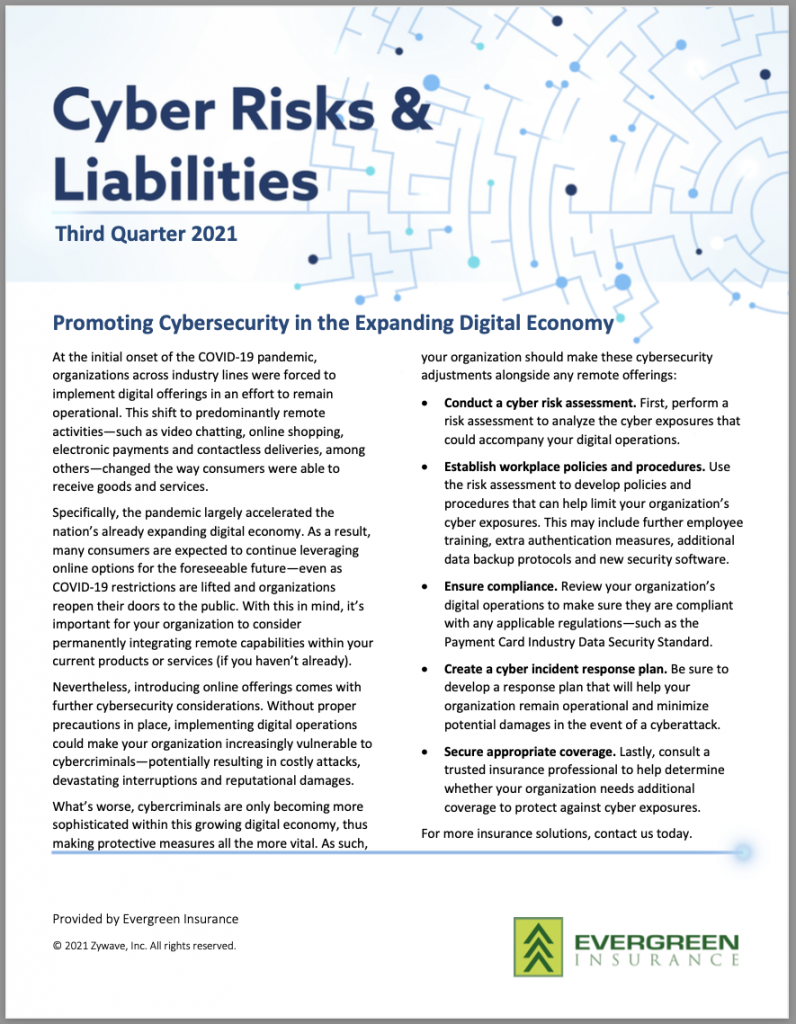

Cyber Risks & Liabilities Newsletter

October is cybersecurity awareness month. While it is always important to be aware of cyber threats, October reminds individuals and businesses that cybersecurity awareness is critical to keeping personal and commercial data safe. Click on the image below to read our cybersecurity newsletter. Articles include:

Contact us today or submit a request for quote for cyber coverage.

Promoting Safety In an Aging Workforce

Jeans Days Mean Community Support

Evergreen loves helping our community! We support many local efforts.

One fun way we collect donations is through the Jeans Day program. Evergreen staff can wear jeans to work on Fridays for a small donation to a local fund. The donations are matched by the company and donated every few months to a deserving local organization.

A recent donation was made to the Dauntless Fire Department in Ebensburg, Pa. Shown is Evergreen’s Caitlyn Altimus presenting the check to the Dauntless team.

Harvesting Equipment

Harvesting equipment is some of the most dangerous machinery you will encounter on the job. You may be less familiar with the seasonal equipment that is used only several days of the year, and you may not be completely aware of the risks associated with harvesting tasks. Before the harvest, familiarize yourself with the equipment and click the image to read or download our Harvesting Equipment tip sheet.

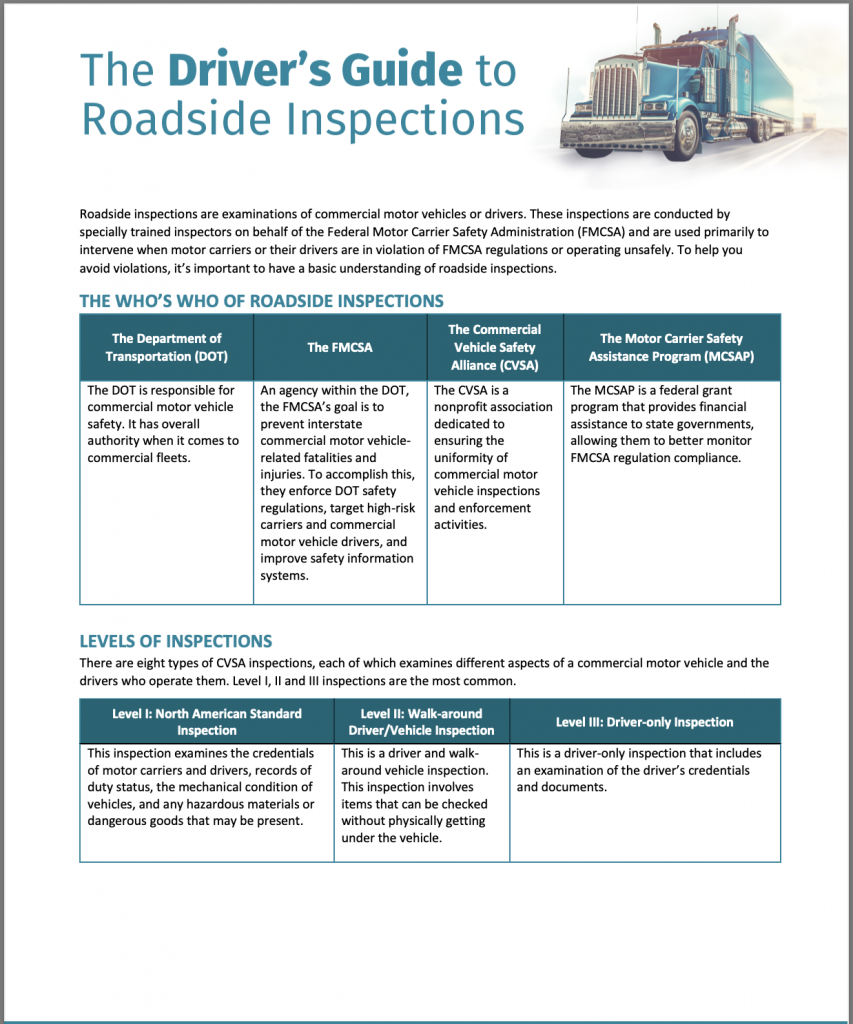

Trucker Safety Inspection

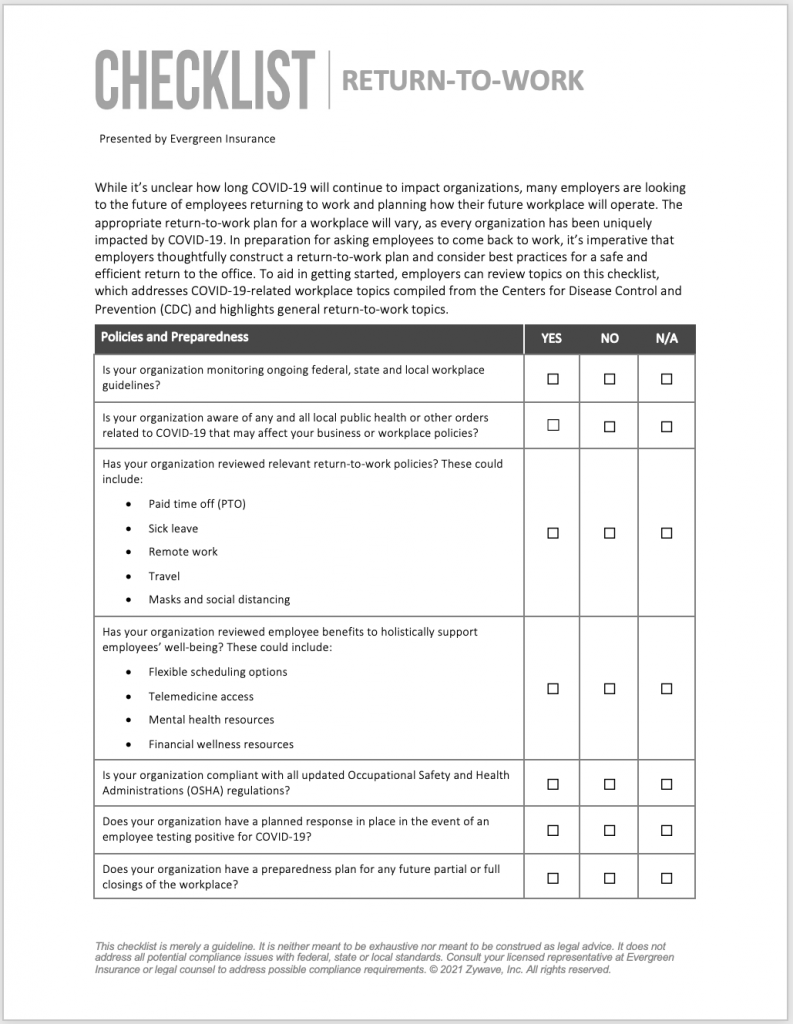

Back to Office Checklist

If your company working from home and ready to return to the office or considering a long-term hybrid model, download our checklist so you can cover the issues and risks. Return to office the most efficient and effective way possible. Contact us with questions related to risks associated with return to office.